Terminal Liability Overview

Generally when pricing is very competitive on an employer group, the Producer and the Underwriter will consider all options to achieve a better price. One of these options of to offer a “12/12” Contract Option with a TLO option. The basis of this approach is to “illustrate” a lower price for the employer over a 12/15, while offering them some cap for their losses over a 12/12 Contract (should their plan burn over the course of the year).

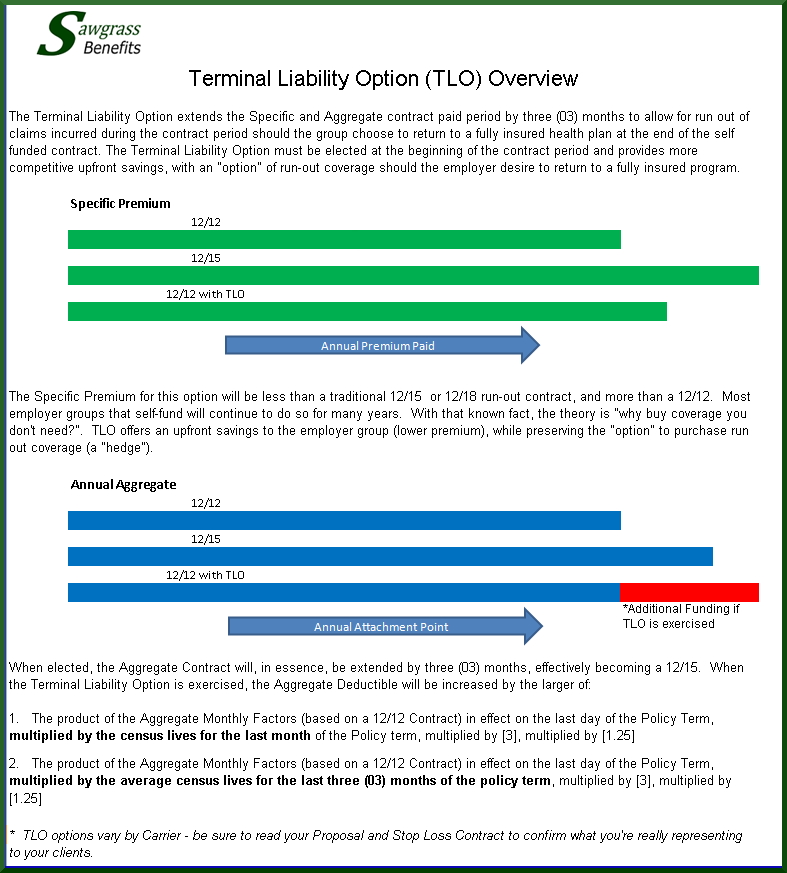

As one can see, there is the potential for ADDITIONAL AGGREGATE FUNDING at the end of the plan year if the claims experience is high. This approach needs to be clearly communicated to your client. For a group less than 50 lives, I would not discuss this option – meaning don’t show them anything over than a 12/15 or 12/18 contract. This Contract Wording is for a more sophisticated business owner who hopefully has previous experience with self funding.

The take-away on the 12/12 w/TLO Option:

Although I’m being critical of the TLO option, its a great tool and is used frequently in the Large Group market. The point is a producer has to do their due diligence…they have to know their clients and only offer products they can thoroughly understand. I hope this Terminal Liability Overview is clear for everyone illustrates the importance of knowing the details of the products you offer your clients.

Good luck and happy hunting…